Plan M

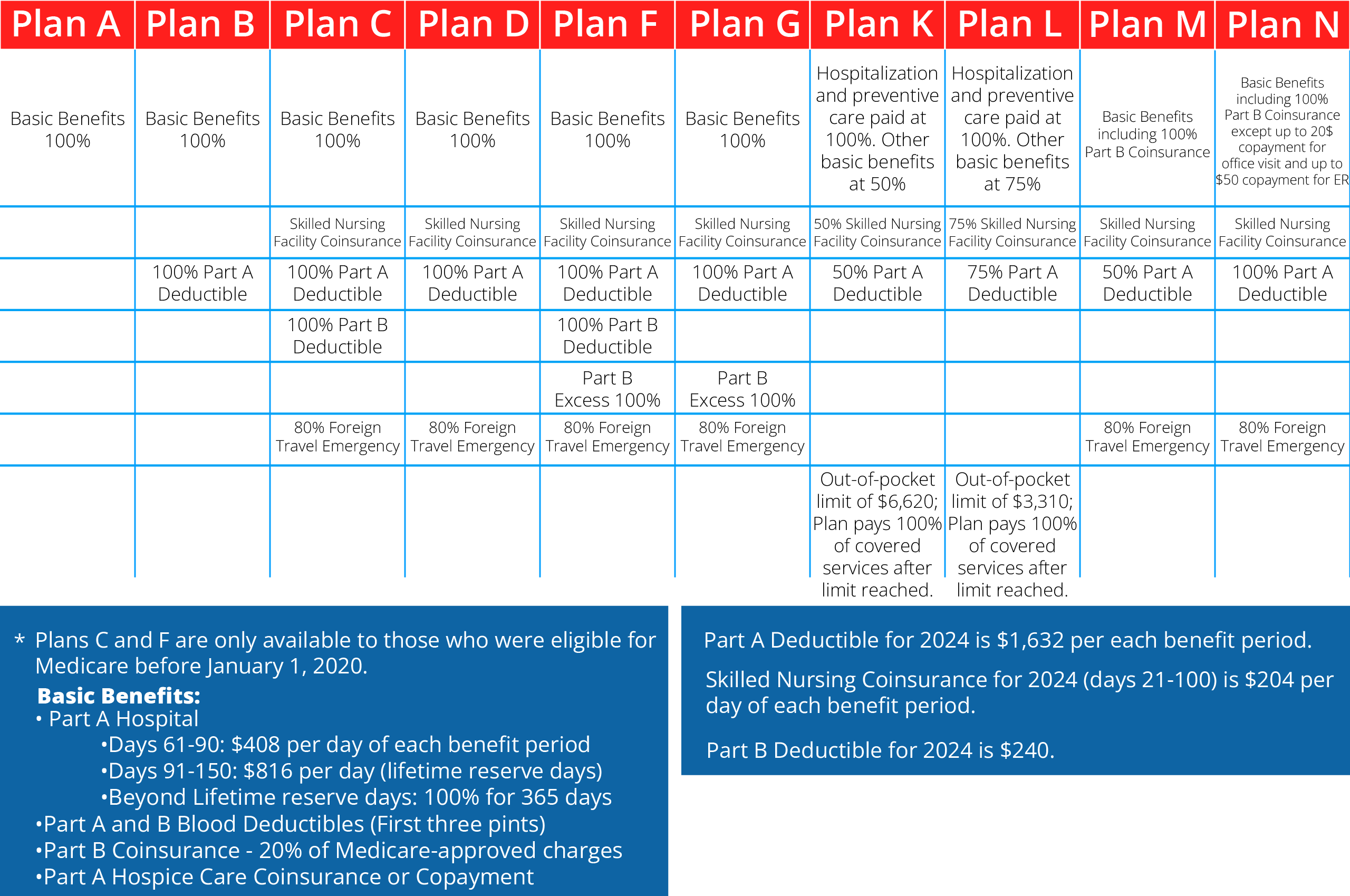

Medicare Supplement Plan M is one of the new supplements created by the Medicare Modernization Act. It first hit the Medicare insurance market in the summer of 2010. It is similar in coverage to Plan D. However, it only covers 50% of the Part A deductible.

Includes |

Does Not Include |

|---|---|

|

Medicare Part A coinsurance and coverage for hospital benefits |

Medicare Part B deductible |

|

Medicare Part B coinsurance or copayment |

Medicare Part B excess charges |

|

Blood (first three pints) |

|

|

Hospice Care coinsurance or copayment |

|

|

Skilled Nursing Facility Care coinsurance |

|

|

Medicare Part A deductible (50%) |

|

|

Foreign Travel Emergency (up to plan limits) |

Is Plan M Right For You? Call Us Today

Plan M could be a good fit for someone who doesn’t expect to visit the hospital often and feels they can afford the occasional cost-sharing. However, it’s always important to have a licensed agent who specializes in Medicare Supplements to help you find a plan that works for you.

The agents with The Benefit Link will evaluate the many different Medigap plans to ensure you stay informed about your options and get the coverage you need!