A Quick Guide to

Medicare Part B

IMPORTANT

2024 Medicare Part B Changes:

- The standard monthly premium of Medicare Part B increased to $164.90/month in 2024.

- The annual deductible for Medicare Part B will be $240 per year in 2024.

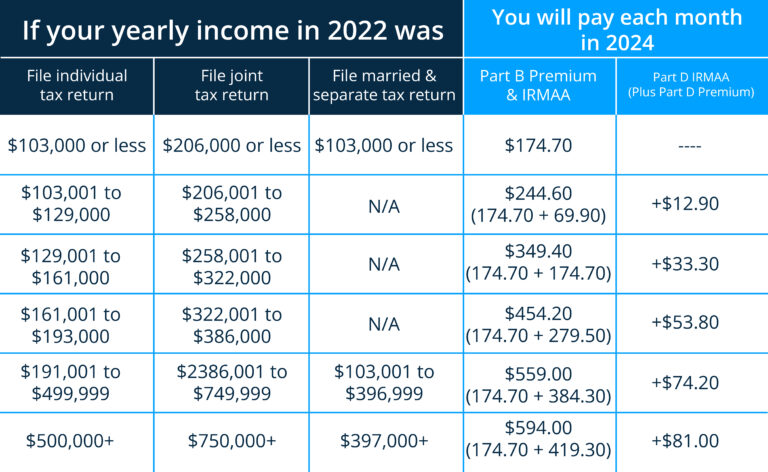

- Most people pay the standard monthly premium amount ($174.70). If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you may pay an Income Related Monthly Adjustment Amount. The Income Related Monthly Adjustment Amount (IRMAA) brackets have been changed as follows:

Medicare Part B (Medical Health Insurance) is an insurance option for people who qualify for Medicare. Its purpose is to cover medically necessary services like doctors’ services, outpatient care, home health services, and other medical services. Part B also covers some preventative services. Part B provides coverage for doctors services outside the hospital setting and other medical services that Part A doesn’t cover.

Additional services covered include:

Speak with a licensed Medicare professional today.

- Doctor visits received as an inpatient at a hospital or at a doctor’s office, or as an outpatient at a hospital or other health care facility

- Medically necessary services or supplies that are needed for the diagnosis or treatment of you medical condition and meet accepted standards of medical practice. (for example, laboratory tests, X-rays, physical therapy or rehabilitation services, etc.)

- Ambulance services

- Some home health care

- Preventative services to prevent illness or detect it at an early stage, when treatment is most likely to work best. (for example, pap tests, flu shots, and colorectal cancer screenings)

You must sign up for Medicare Part B and pay a monthly premium, and yearly deductible. The cost for the premium is deducted from your Social Security check. Costs for Part B depend on if you have Original Medicare or are in a Medicare health plan. For some services, there are no costs, but you may have to pay for the visit to the doctor. If the Part B deductible applies, you must pay all costs until you meet the early Part B deductible before Medicare begins to pay its share. Then, after your deductible is met, you typically pay 20% of the Medicare approved amount of the service. You can save money if you choose doctors or providers who accept assignment. You also may be able to save money on your Medicare costs if you have limited income and resources.

Most people will continue to pay the same Part B premium they paid last year.

If you do not sign up for Medicare Part B when you are first eligible, you may have to permanently pay a higher monthly premium.

How do I know if I have Medicare Part B coverage?

Your Medicare card will tell you if you have Part B coverage. If you have it, Medicare Part B will be listed on your card. Don’t worry if you are not covered, you can still sign up. However, it may cost you more if your initial enrollment period has ended.

To enroll, visit your local Social Security office or call the Social Security Administration at 1-800-722-1213. TTY users should call 1-800-325-0778.

Part B is not free. There’s a monthly fee that is usually taken right out of your Social Security payment or retirement benefits. The fees range depending on your income. There is also a yearly deductible for Part B services. After you pay the deductible, your Part B benefit begins. In most cases any purchases will have a 20% co-pay.

When you sign up, you will be given options. Choose carefully because the benefits are different under the following options. You may choose between:

- Original Medicare Plan

- Medicare Advantage Plans (HMOs, or PPOs)

- Medigap / Medicare Supplemental Plans

- Medicare Private Fee-For-Service Plan (also a type of Medicare Advantage plan)

Still have questions, or need more information on how to pick the plan that is right for you?

The Benefit Link is here to help! Give us a call and speak to a licensed insurance agent:

Schedule A Consultation

It can be difficult to know whether or not you have proper coverage, but we can help!